Used car inventory levels grew by 4.7% in September, but the improved supply did nothing to stem price growth.

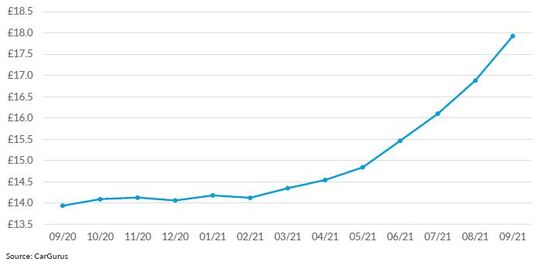

The average used vehicle listed jumped by 6.2% from August and is up 28.6%, year-over-year, according to the latest Used Car Availability Index from CarGurus.

Kevin Roberts, director of industry insights and analytics for CarGurus, said: “There had been a hope that August could be a turning point in the ongoing chip shortage currently battering the global automotive industry; however, that hope came and went with the reality that a resolution in 2021 is not likely.

“Seasonal changes as well as some exogenous shocks led to shifts in the narrative as we put a bow on the third quarter. However, the underlying uncertainty caused by high demand and limited supply remains.”

While the CarGuru’s report shows that inventory levels increased in September, Roberts said it was likely caused by both a cyclical decline in used sales in September as well as the petrol shortage at the end of the month, which could have caused consumers to delay purchases.

He continued: “One trend that continued and picked up pace in September was the increase in average listing prices. The average used price increased 6.2% to £17,928; the figure is even more impressive when compared to last year, with prices now up 28.6%. With new vehicle assembly likely to remain impacted in 2022, it’s probable that we’ll see additional price increases in the coming months.”

The record used car value increases in September were hailed as a “black swan event” by Cap HPI, with head of valuations Derren Martin describing the seventh consecutive month of rising prices as “extraordinary”.

Market analysis from the valuations provider showed that live valuations had recorded an average 5.9% increase in values – equivalent to £860 – at three-years, 60,000-miles and said that such a rise had not been expected.

In monetary terms, the rise was the highest ever recorded by Cap HPI, eclipsing the 6.7% increase in June’s monthly figures, which was equivalent to £825.

Another data point, highlighted by CarGurus, that continued to accelerate was days-on-market, which dropped to 56 days in September - a decrease of 8.8% from August and down 18.4% year-over-year.

Seasonal declines in used sales could help to bolster used inventory somewhat in the fourth quarter, according to Roberts. However, with new production still impacted, he said gains will likely be modest, if at all, and average listing prices could increase if consumer demand remains strong.

Login to comment

Comments

No comments have been made yet.