Following the long-awaited FCA update on the motor finance industry, much of the focus has been on the commission arrangements and the FCA’s view that current structures, in particular Difference in Charge (DiC) can lead to higher interest rates for consumers.

The DiC model is not present in other lending environments, and the regulator is suggesting it will intervene, and possibly ban these structures in the future.

However, what is the real cost of compliance to dealerships; and how do lenders effectively police it?

From a dealership’s perspective simply distributing the right documentation is not enough. The timing of disclosures, including recommendations of finance type and the terms of financial agreements needs to be front and centre of all discussions with customers to ensure they have the right information to make an informed decision.

In some cases, this could mean a change in mind set from selling cars to selling a financial product, recognising that for many, the purchase of a car is a material financial commitment. Staff training, and sales culture are as important as regulatory compliant forms.

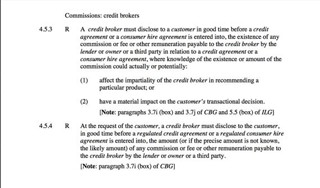

The disclosure of commission, especially in respect of DiC and similar commission models where the broker has discretion to adjust the interest rate is a particular concern for the FCA.

The Consumer Credit source book is clear that disclosure needs to be made in good time, in particular where a broker’s impartiality could be affected, a potential outcome of the DiC and similar models. The presentation of information must also meet the Regulator’s ‘clear, fair and not misleading’ requirements.

In addition, lenders have a role to play to ensure that the rules relating to the disclosure of commission is adhered to.

Whilst the control frameworks may be robustly designed, the practical application in some cases may not be consistently adhered to.

The FCA emphasises that whilst disclosure responsibilities can be delegated by lenders, oversight is still required; so, we expect to see a greater level of monitoring from lenders in the future.

For Lenders, there is also a greater responsibility to assess the affordability risk in each individual case.

The new rules that came into force in November 2018 increase the scope of assessment, and dealers need to ensure these more rigorous checks are done to establish whether a customer can afford the repayments.

For example, rather than just looking at the income figure, other outgoings such as credit card debt and living expenses, similar to a mortgage application must be applied.

The real cost of compliance comes where dealerships and lenders need to invest in better processes, internal education and administration to ensure compliance – adding greater financial pressure on businesses.

However, this is crucial to avoid further investigation and the reputational damage this could have on a business.

Like most things’ prevention is better than the cure and the recurring theme of reviewing policies and procedures is clear within the FCA’s recommendations; so undertaking a review now, is key to compliance and sustainable growth in the motor market.

Author: Neil Pickles, risk assurance director at RSM

adamwest79 - 18/03/2019 11:18

"The real cost of compliance comes where dealerships and lenders need to invest in better processes, internal education and administration to ensure compliance – adding greater financial pressure on businesses." - Disagree, the real cost will be when dealers can't unfairly overcharge the consumer so they can receive more commission.