The Society of Motor Manufacturers and Traders (SMMT) has said that electric vehicles’ share of new car registrations could double in 2020 after sales almost tripled amid a 4.1% decline in the wider market during in July.

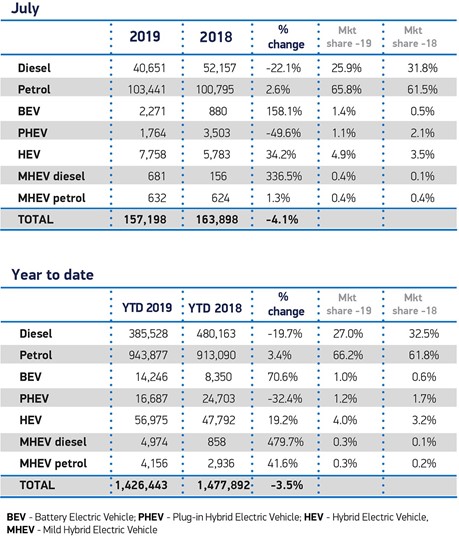

As the volume of new vehicles registered last month fell to 157,198 – the lowest July total since 2012 – sales of pure, battery-powered electric vehicles were up 158.1% to 2,271.

Despite a rise in market share to 1.4% for EVs during July, EVs still command just 0.5% of the market.

Despite a rise in market share to 1.4% for EVs during July, EVs still command just 0.5% of the market.

But the EV sales boom came in the same month that the Government announced a zero BIK tax band for company car drivers in 2020/21 and the SMMT believes that the tide is now turning towards greater adoption of the new ultra-low emission technology.

A statement issued by the SMMT alongside publication of today’s (August 5) registration results, the SMMT said: “SMMT forecasts this ongoing investment into new, ever more advanced powertrain technology will result in battery electric vehicles doubling their market share next year, with 51,000 registrations in 2020.

“However, this will still represent only 2.2% of the overall market. For the UK is to meet its zero emission ambitions, we need world-class, long-term incentives, supportive policies and substantial investment in infrastructure.”

The SMMT said that manufacturers’ investment in a growing range of powertrain options meant that there were now more than 80 alternative fuel vehicle (AFV) models available in the UK.

Among the key new arrivals to the pure EV market in 2019 are the Tesla Model 3, MG ZS EV, the Peugeot e-208 and the all new Corsa-e, with Honda's Honda e hatchback due early next year.

Commenting on July’s rise in EV registrations, SMMT chief executive Mike Hawes said: “Despite yet another month of decline in the new car market, it’s encouraging to see substantial growth in zero emission vehicles.

“Thanks to manufacturers’ investment in these new technologies over many years, these cars are coming to market in greater numbers than ever before.

“If the UK is to meet its environmental ambitions, however, government must create the right conditions to drive uptake, including long-term incentives and investment in infrastructure.

“The fastest way to address air quality concerns is through fleet renewal so buyers need to be given the confidence to invest in the new, cleaner vehicles that best suit their driving needs, regardless of how they are powered.”

The SMMT said that uncertainty and confusion over future government policy on different fuel types continued to knock consumer and business confidence as the market slipped to a fifth consecutive month of declining registrations in July – leaving it 3.48% down at 1.43 million registrations year-to-date.

Registrations of diesel vehicles fell for the 28th month, down by 22.1%, while petrol powered vehicles remained stable, with 2,646 more registrations than in July 2018, the SMMT said.

Registrations of Hybrid electric cars increased by a substantial 34.2%, with 7,758 of these low-emission vehicles joining UK roads.

Meanwhile, plug-in hybrid electric vehicles continued their recent decline, down by 49.6%.

Declines were seen across all sectors during July as private demand fell by 2%.

Deliveries for fleet and business customers were down 4.7% and 22.5%, respectively, meanwhile.

Luxury saloons and specialist sports cars experienced a rise in registrations in the month with volumes driven by increased demand for dual purpose vehicles, up 12.8% to take nearly a quarter (24.4%) of the market.

All other segments experienced declines in the month, with the biggest falls seen in executive (down 21.6%) and supermini (down 12.1%) segments, the SMMT reported.

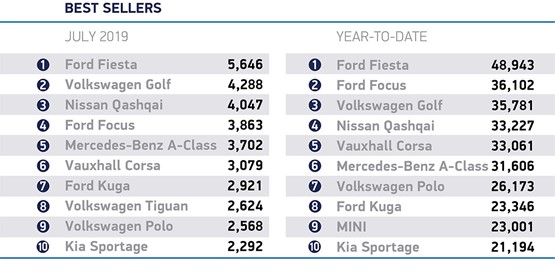

Among the manufacturers who posted impressive sales results during July were Citroen (up 29.3%), Ford (up 6.4%), Jaguar (up 12.6%), Lexus (up 42.6%), Mazda (up 9.9%), Mercedes-Benz (up 5.8%) and Toyota (up 22.7%).

Commenting on the SMMT registrations data published today, Jon Lawes, managing director at Hitachi Capital Vehicle Solutions, said that while a 70.6% year-to-date increase in battery electric registrations and its highest market share to date is encouraging for the future state of the market "significant obstacles remain".

He said: "A 49.6% decline in plug-in hybrid models shows that the decision to exclude many of these vehicles from qualifying for subsidies is continuing to take its toll, and the lack of electric plug-in infrastructure is still hindering the transition to AFVs more widely.

“With a 62% majority in our recent research supporting the move to electric models, the appetite is there but the Government must work harder to incentivise greener vehicle purchases.”

Login to comment

Comments

No comments have been made yet.