February’s new car registrations remained 25.9% down on pre-pandemic 2020 as Russia’s invasion of the Ukraine created increasing doubt about a volume recovery for car retailers.

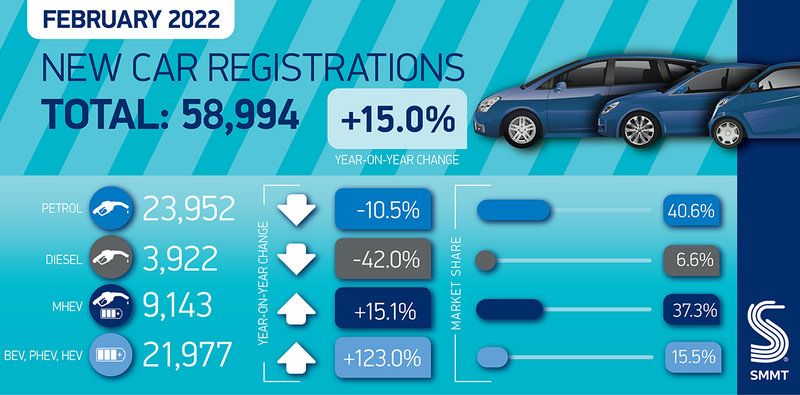

Registration were 15% up year-on-year last month – reaching 58,994 – but that comparison came against a period of COVID-19 restrictions which saw retailers’ ability to sell cars stymied by closed showrooms.

Private registrations rose by 30% as large fleet registrations remained stable, up just 2%, according to the Society of Motor Manufacturers and Traders (SMMT) data.

But, as AM reported yesterday (March 3), the Ukraine conflict has become another factor to compound ongoing vehicle supply issues and undermine hopes of a volume recovery later in the year.

SMMT's EV push

SMMT chief executive, Mike Hawes, shifted his focus away from the ongoing supply issues and towards Government’s promotion of electric vehicle (EV) sales in his comments on the February registrations results.

“Despite February’s traditional low registration numbers, consumers are switching to EVs in ever-increasing numbers”, he said. “More than ever, infrastructure investment needs to accelerate to match this growth.

“Government must use its upcoming Spring Statement to enable this transition, continuing support for home and workplace charging, boosting public charge point rollout to tackle charging anxiety and, given the massive increase in energy prices, reducing VAT on public charging points.

“This will energise both consumer and business confidence and accelerate our switch to zero emission mobility.”

Hawes’ comments on EV infrastructure and taxation come just over a fortnight after the industry body called on Government to create a new regulator to accelerate the expansion of the electric vehicle (EV) charge points and boost public confidence in the technology.

EVs claimed a 17.7% market share to reach 10,417 registrations last month, according to the SMMT.

EVs claimed a 17.7% market share to reach 10,417 registrations last month, according to the SMMT.

Registrations of plug-in hybrids (PHEVs) rose to 4,677 units and a 7.9% share of the market.

Including non-plug-in hybrid registrations (6,883), electrified vehicles accounted for more than a third of all new cars leaving dealerships.

No 'March mayhem'

The SMMT said: “While this demonstrates the growing demand for electric cars, February is typically the lowest volume month, as many buyers delay purchases until the ‘new plate’ month of March, and fluctuations in supply for some key models can have a more pronounced effect in terms of market share.”

In conversation with AM this week, car retail group bosses starting their March trading period said that current market trends would smooth out the “boom and bust” trends of the franchised motor retail sector – potentially leaving March trading down on traditional highs.

Typifying the response of the business leaders AM spoke to, Perrys Motor Group managing director Darren Ardron said: “What we saw in February was that, as a result of the long lead times, customers are more inclined to come in an collect their cars when they arrive.

Typifying the response of the business leaders AM spoke to, Perrys Motor Group managing director Darren Ardron said: “What we saw in February was that, as a result of the long lead times, customers are more inclined to come in an collect their cars when they arrive.

“The result was probably a better than normal February for us, as people didn’t wait for the March ‘plate change to come and receive their handover.”

With supplies constrained, car retailers’ moods remain generally buoyant thanks to full order books stretching to the end of the year.

Robin Luscombe, the managing director of Luscombe Motors said: “There are no shortage of customers for cars.”

'Red hot' market

Ian Plummer, commercial director at Auto Trader, said that February’s new car registrations results falsely paint a picture of a “weak” new car market.

He said: “These figures paint a picture of a weak new car market – but looks can be deceiving. If you peek under the bonnet, there are all the signs of pent-up demand that could really set the market on fire later this year.

“Speak to any manufacturer or motor retailer, and they’ll tell you that the market is red-hot and that their order books are full to bursting for months to come.”

Plummer is among those banking on a ramp-up in new car supply later this year.

He said: “The car industry’s well-documented issues with semi-conductor shortages have so far acted as a brake on the demand of an army of would-be buyers with COVID savings. But as production ramps up again that dam looks set to burst later this year as new deliveries pick up speed.”

In his comments on the February registrations results, Close Brothers Motor Finance managing director, Sean Kemple, praised the retail sector's resilience as the industry headwinds appeared to grow stronger.

He said: “After a tough couple of years battling the industry impact from a global pandemic, the potential knock-on effects for the car market as a result of the current macro environment have yet to be made clear, particularly given countries in Eastern Europe are critical suppliers of vital components in semi-conductors.

“Separately consumers will inevitably see petrol prices rise even more significantly than the current, already stringent increases.

“Despite the consistent challenges the industry is coming up against, dealers have been incredibly resilient so far, consumer demand for car-buying is still shown to be unwavering, and as these challenges ease, the market will be waiting as production ramps up once again.”

> DATA: UK new car registrations figures, total and by manufacturer

Login to comment

Comments

No comments have been made yet.