High new and used car prices will continue to drive the motor finance sector's growth by value despite a cost-of-living crisis that will “subdue consumer spending in the coming months”, the FLA has said.

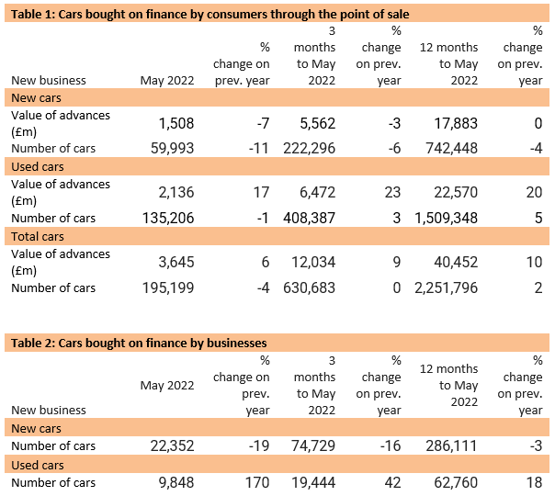

Market data published by the Finance and Leasing Association has revealed that that consumer car finance new business volumes fell 4% year-on-year, to 195,199 units, in May as the value of new business grew by 6%, to £3.65 billion.

And the trend of manufacturers prioritising high-value and electric vehicles (EV) amid the current supply shortages, and the impact of a lack of supply on used car prices, look set to ensure the value of the sector continues to grow in spite of a growing cost of living crisis.

Geraldine Kilkelly, the FLA’s director of research and chief economist, said: “May saw a continuation of recent trends in the consumer car finance market with vehicle shortages weighing on new business volumes in the new car finance market, and higher new and used car prices leading to further growth in average advances.

Geraldine Kilkelly, the FLA’s director of research and chief economist, said: “May saw a continuation of recent trends in the consumer car finance market with vehicle shortages weighing on new business volumes in the new car finance market, and higher new and used car prices leading to further growth in average advances.

“Pressures on household incomes from higher inflation, interest rates and taxes are expected to subdue consumer spending in the coming months.

“Growth in the value of consumer car finance new business is expected to be relatively modest at 4% in Q3 2022 and 5% in Q4 2022 compared with the same quarter in 2021.”

Addressing the issue that some motorists may find themselves struggling to pay for their vehicle as pressure on household incomes grow, Kilkelly added: “As always, customers who are worried about meeting payments should speak to their lender as soon as possible to find a solution.”

The FLA’s data showed that the consumer new car finance market reported a year-on-year fall in new business of 7% by value, to £1.51bn, and 11% by volume, to 59,993.

The consumer used car finance market reported new business up 17% by value, to £2.14bn, but 1% lower by volume at 135,206.

This reflects comments made by Cap HPI director of valuations Derren Martin who recently told AM that the used car sector would be a “bloodbath” without limited supply keeping values high.

In the business sector, the number of new cars sold on finance in May slumped 19% in May to 22,352 as used car sales funded by FLA members grew 170% to 9,848.

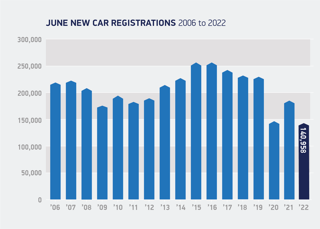

This reflects the data seen in the recent Society of Motor Manufacturers and Traders (SMMT) new car registrations data for June, which showed that OEMs are currently prioritising private customers over fleet and leasing companies.

Login to comment

Comments

No comments have been made yet.