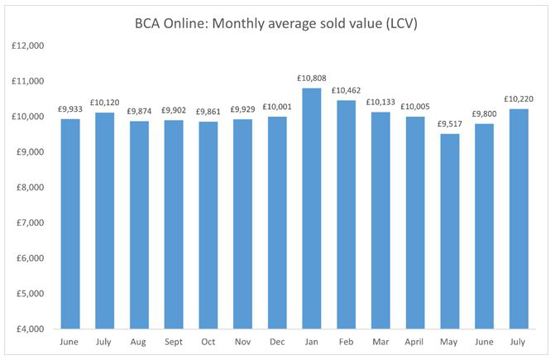

The average cost of a used light commercial vehicle sold in BCA's auctions during July was £10,220, a 4.2% rise month on month.

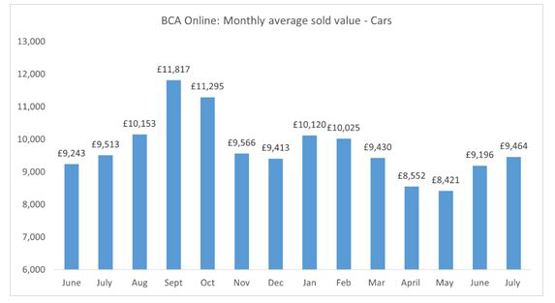

The auction group's data shows the average cost of a used car at its sales rose again in July too, by 2.9% to £9,464.

In LCVs, improved demand and rising buyer numbers contributed to the increase in average values at BCA over the past two months, following consecutive monthly falls from the all-time market highpoint of £10,808 recorded in January of this year.

Sale conversion rates have improved by several percentage points in recent weeks, with a BCA noting a particular rise in demand for 4x4 LCVs and continued interest for conversions and body builds.

In used cars, value performance against guide values rose to 97.7% in July, up marginally compared to June, with sold volumes remaining broadly level with the previous month.

The data provided further evidence that dealers remain laser focussed on vehicles that can be sold quickly, often buying to order and generating good retail churn despite the challenging economic conditions, said BCA UK chief operating officer Stuart Pearson.

The data provided further evidence that dealers remain laser focussed on vehicles that can be sold quickly, often buying to order and generating good retail churn despite the challenging economic conditions, said BCA UK chief operating officer Stuart Pearson.

Pearson added “There has been a divide forming in the market with the shortage of ex-lease, rental and OEM stock ensuring resilient prices for 1–4-year-old vehicles, whilst at the lower end, some of the poorer condition part-exchange vehicles have seen prices drop more dramatically as dealers have concerns over potentially expensive preparation costs and delays in parts supply.”

Regarding LCVs, Pearson said average values were boosted to some extent by improvement to product mix, albeit it there was also some seasonal impact on volume.

"As we are seeing in the car market, it is apparent that a two-tier market has developed, where the best presented vehicles readily attract strong bidding and poorer stock will struggle unless it is very competitively valued.”

He added: “Despite the obvious pressures in the used sector, we should expect values to remain reasonably resilient in the medium to long term. The new LCV market fell 20.7% in July, the seventh consecutive month of year-on-year decline as the sector continues to face supply chain issues and long delivery times.

"It means that any business requiring a commercial vehicle at short notice will have to source it through the used sector, which should generate sustained demand and relatively stable pricing in the wholesale markets for some time.”

Login to comment

Comments

No comments have been made yet.