National Franchised Dealers Association (NFDA) concerns about the impact of the agency model and OEMs’ direct sales on the car retail sector have been laid bare in consultation documents published this week.

The NFDA’s Consultation Position Paper and Response to the Competition and Markets Authority (CMA) on “Retained Vertical Agreements Block Exemption Regulation” has revealed the extent of what is at stake as new rules are established ahead of the existing Vertical Block Exemption Regulation 330/2010 (VBER) expiration in May, 2022.

In its comments to the CMA, the NFDA pointed out that the UK’s automotive retail sector was “crucial to UK and European mobility and prosperity”, providing almost 600,000 jobs.

But it stated that increased consolidation among car retailers and manufacturers along with OEMs’ direct sales and agency model strategies – along with the risk of increased control of the customer journey – posed a threat to competition and value for car buying consumers.

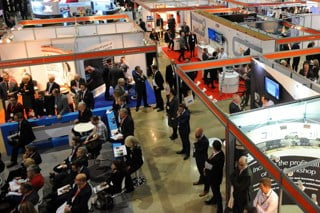

- Block exemption regulation will be at the top of the NFDA's talking points as it attends Automotive Management Live 2021 today.

It said: “The NFDA believes that a new regulation (and accompanying guidance) could strike a better balance in this respect, as well as providing greater legal certainty for all businesses involved.

“Addressing these issues will work towards preserving and enhancing the benefits that consumers have experienced historically through strong intra-brand competition. These benefits are currently at risk as a result of increased OEM focus on cost reduction and profitability.”

In its submissions, the NFDA stated: “If inter-brand competition is reducing, which it is, then in order to protect consumer welfare, as well as dealer employment and investment, it is crucial that legislatures and regulators take steps to safeguard competition at the retail level.

“Preserving healthy intra-brand competition and allowing OEMs to adapt, innovate and drive efficiencies are not mutually exclusive.

“The major risk, however, lies in undervaluing the importance of appropriate checks and balances in the OEM/dealer relationship (which can be achieved through proportionate sector-specific regulation).

“Given the economic dependence of dealers on OEMs, the continued absence of these checks and balances (or any failure to make them robust) will allow OEMs to exert even more control over the dealer model.

“This may, over time, lead to dealer disintermediation, the loss of intra-brand competition and a concomitant reduction in consumer welfare.

“The current Retained VBER review (as well the review of the sector specific retained motor vehicle block exemption that the CMA may undertake in due course) affords the CMA the opportunity to develop and/or improve appropriate sector-specific regulation (or guidance) to address these concerns, without creating a regulatory framework that prevents OEMs and distribution channels from adapting to market evolution and economic shocks.

“Addressing these issues will work towards preserving and enhancing the benefits that consumers have experienced historically through strong intra-brand competition. These benefits are currently at risk as a result of increased OEM focus on cost reduction and profitability.”

Within the NFDA’s evidence to the CMA, it highlighted a risk of reduced competition through consolidation of retailer and OEM business.

It highlighted the move to reduce franchised car retail network scale by Vauxhall, Honda, Ford and the withdrawal of Mitsubishi from the UK market.

It also drew on research from Autovista, which estimated that the number of dealerships in Europe has fallen by 16% since 2010.

The NFDA also expressed hope that the CMA would be able to roll out an improved block exemption framework that would ensure the car retail sector remained competitive and profitable after May next year.

It called for insightful and balanced regulation, which:

- Fosters confidence and investment at all levels of the supply chain, including in offline and online retail channels, through fairer, more transparent and predictable terms.

- Accommodates new product development and evolving consumer preferences, reducing the burden of unnecessarily prescriptive and onerous standards in selective distribution systems.

- Improves the competitive independence of those closest to the consumer (notably retailers) and

The NFDA said: “There is real scope for regulation to be improved to promote fairer business to business trading practices and greater competitive independence for smaller parties in the supply chain who have traditionally been more vulnerable to the application of subtle or indirect restrictions (economic as well as contractual) on their activities.”

To read the NFDA’s Consultation Position Paper and Response to the Competition and Markets Authority (CMA) on “Retained Vertical Agreements Block Exemption Regulation” in full, click here.

Login to comment

Comments

No comments have been made yet.