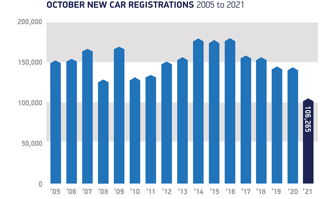

New car registrations rose just 1% in 2021 as tougher trading arrangements, accelerating technology shifts and decimated supply stalled the sector’s recovery from COVID-19.

Data published by the Society of Motor Manufacturers and Traders (SMMT) today (January 6) showed that 1.65 million cars were registered in the UK last year, leaving volumes 28.7% down on pre-COVID trading in 2019.

An 18.2% decline in December registrations resulted in the sector’s second-worst year of new car registrations since 1992 and SMMT chief executive, Mike Hawes, warned that the challenges faced last year look set to continue in 2022.

The SMMT’s latest registrations forecast for 2022 – published in October, before the rise of the Omicron variant – is for 1.96 million new car registrations.

'Desperately disappointing year'

But Hawes said: “It’s been another desperately disappointing year for the car industry as COVID continues to cast a pall over any recovery.

“Manufacturers continue to battle myriad challenges, with tougher trading arrangements, accelerating technology shifts and, above all, the global semiconductor shortage which is decimating supply.

“Despite the challenges, the undeniable bright spot is the growth in electric car uptake. A record-breaking year for the cleanest, greenest vehicles is testament to the investment made by the industry over the past decade and the inherent attractiveness of the technology.

“The models are there - with two of every five new car models now able to be plugged in - drivers have the widest choice ever and industry is working hard to overcome COVID-related supply constraints.

“The biggest obstacle to our shared net zero ambitions is not product availability, however, but cost and charging infrastructure.

“Recent cuts to incentives and home charging grants should be reversed and we need to boost the roll out of public on-street charging with mandated targets, providing every driver, wherever they live, with the assurance they can charge where they want and when they want.”

Registrations by private buyers increased by a moderate 7.3% across 2021, while those by businesses and large fleets declined by 4.4% and 4.7%.

Despite limited vehicle supplies, last year did prove to be the most successful year in history for electric vehicle (EV) uptake, according to the SMMT’s data, however.

UK ranked 9th for EV market share

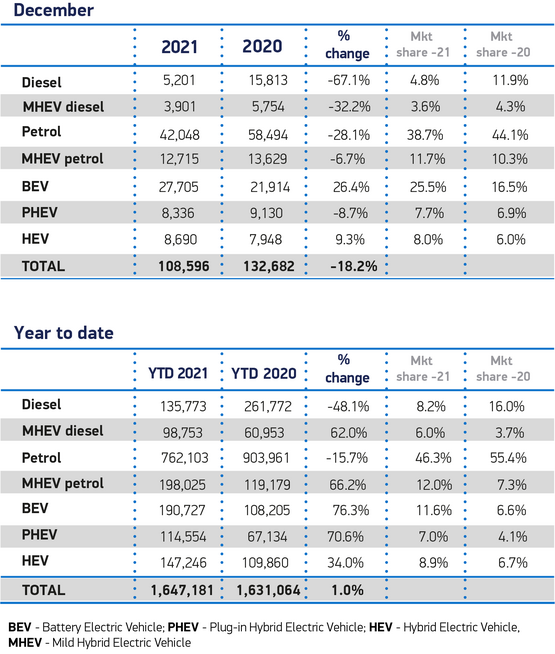

More new EVs were registered than over the previous five years combined, with around 190,000 joining UK roads alongside 115,000 plug-in hybrids (PHEVs), meaning 18.5% of all new cars registered in 2021 can be plugged in.

In December, EVs accounted for 25.6% of all new registrations.

In December, EVs accounted for 25.6% of all new registrations.

Across 2021 as a whole, petrol vehicles, including mild hybrids (MHEVs), accounted for 58.3% of all registrations, with diesel-powered cars including MHEVs making up 14.2% of the market, followed by EVs at 11.6%, hybrid electric vehicles (HEVs) at 8.9% and PHEVs at 7.0%

Following billions of pounds of investment into new technology by manufacturers, more than 40% of models are now available as plug-ins, the SMMT said.

However, the SMMT said that the UK finished 2021 in ninth position overall in Europe for EVs by market share, “underlining the progress still to be made, despite the UK having amongst the most ambitious targets of all major markets with the end of sale of new petrol and diesel cars scheduled for 2030”.

It added that recent cuts to Government's plug-in car grant (PiCG) and grants for home chargers, put the achievement of industry’s and government’s net zero ambitions at risk, adding: “Furthermore, the slow pace of growth in on-street public charging – where, on average, 16 cars potentially share one standard on-street charger – could put the brake on EV demand and undermine the UK’s attractiveness as a place to sell electric cars.”

Dealers' 'cause fro optimism'

The recent Outlook 2022 car dealer survey conducted by AM, in partnership with JudgeService, showed that car retailers were looking ahead to this year with uncertainty, but the National Franchised Dealers Association (NFDA) highlighted that there was "cause for optimism".

Chief executive, Sue Robinson, said: "2021 was a roller coaster year for new car registrations with lockdowns affecting demand at the start and the global shipping crisis and semiconductor shortage impacting supply towards the end of the year, resulting in the overall market being 28.7% down from pre-pandemic levels.

Chief executive, Sue Robinson, said: "2021 was a roller coaster year for new car registrations with lockdowns affecting demand at the start and the global shipping crisis and semiconductor shortage impacting supply towards the end of the year, resulting in the overall market being 28.7% down from pre-pandemic levels.

“Despite the recent challenges, there is cause for optimism. A poll conducted by NFDA revealed that 78.6%* of franchised vehicle dealers are optimistic about the level of demand in the year ahead as consumer confidence improves while we move through the pandemic and the electrification of the UK car parc continues apace."

Robinson added: “It is encouraging that sales of electric vehicles experienced significant growth in 2021, driven by the growing range of models available and retailers’ efforts to help their customers make informed choices.

"However, it is important that the transition to zero emissions continues to be supported by investments in the charging infrastructure and financial incentives for EV buyers. As a result, the recent cut to the plug-in grant was disappointing.

“Throughout 2022, we are confident retailers will continue to show their resilience and ability to meet buyers’ demand with growing footfall levels in showrooms and an ever-improving online offering from dealers”.

Login to comment

Comments

No comments have been made yet.