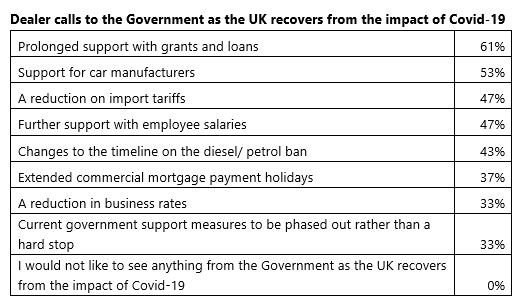

Six-in-10 car retailers believe that prolonged grants and loans from Government are required to support the automotive retail sector through the COVID-19 coronavirus crisis as forced redundancies begin.

A survey conducted by Close Brothers Motor Finance found that 61% thought the ongoing support would be necessary, with just over half (53%) calling on manufacturer support as they formed lockdown recovery plans this month.

The response came as dealers laid bare the strain placed on their business in the first month of lockdown alone.

While 47% of dealers told the survey – conducted among 51 retailers between April 21 and 22 – that they had furloughed staff under the Government’s now extended Coronavirus Job Retention Scheme (CJRS), 43% said that they had already been forced to "lay peope off".

And 55% of dealers said that they’d taken out more finance in order to stay afloat.

Seán Kemple, director of sales at Close Brothers Motor Finance, said: “COVID-19 has brought the UK economy to its knees, and with most showrooms and forecourts closed the motor industry has been hit hard.

“Government has already introduced a number of measures including cuts to business rates, the furlough scheme, and frozen fuel duties, but the environment remains undeniably difficult.”

Kemple said that it was “really positive to see some UK car manufacturers safely returning to work” but pointed out that, with social distancing measures in place, the speed of production will be severely limited.

He added: “This, combined with damaged consumer confidence, means the future is uncertain.

“Dealers are working hard to find ways to support their staff and their customers, and as the backbone of the car industry, it’s vital that they are properly supported.”

As AM prepares to reveal the findings of its recent ‘COVID-19 franchised car retailers' OEM and state support survey’ and ‘COVID-19 Recovery Survey’ in its coming digital edition, Close Brothers’ survey highlighted car retailers’ recovery priorities.

Following last week’s news from the Society of Motor Manufacturers (SMMT) of a new car sales slump of 97% year-on-year in April, this week's report on a 30.7% slump in used car sales in March and Jato Dynamics’ prediction of a U-shaped new car market recovery across Europe.

Half of dealers (49%) reported issues sourcing stock, an issue which could be alleviated by the return to trading of Cox Automotive’ s Manheim auctions, the Motorway online stocking tool this week, among others.

Close Brothers found that, despite lockdown, it was clear that dealers are spending a lot of time offering continued advice to customers.

Half (49%) said that they had dealt with customers unclear about whether to/how to buy a car during lockdown, and a quarter (25%) with customers unclear about how to collect a car they had already ordered/ agreed to purchase.

Looking to other measures that they felt could aid their recovery from the current COVID-19 crisis, 47% of dealers want to see a reduction on import tariffs, and 43% are calling for changes to the timeline on the diesel/petrol ban.

Looking to other measures that they felt could aid their recovery from the current COVID-19 crisis, 47% of dealers want to see a reduction on import tariffs, and 43% are calling for changes to the timeline on the diesel/petrol ban.

In February, the ban on petrol and diesel cars was brought forward from 2040 to 2035, and dealers expressed concern at the time that the ambition was overly challenging without more investment in infrastructure and education.

Earlier this month the ICDP’s ‘clean cars for a post-COVID recovery’ report called for a CO2 emissions-reducing car scrappage scheme to boost the sector’s recovery.

It said that such a scheme was needed in order to avoid a perfect storm of stalled sales and soaring fines from stringent new EU regulations driving carmakers ‘to the edge’.

Close Brothers claimed that its survey did show “some silver linings for the future”.

Increased social media interest was reported by 45% of dealers as consumer demand shifted online, and a 31% have taken lockdown as an opportunity to build up the online presence of their dealership to support current and future sales.

Almost one in five (18%) have introduced a delivery service in order to safely meet the continued demand, meanwhile.

Login to comment

Comments

No comments have been made yet.