Auto Trader has said it expects the UK’s car retail sector to deliver a “fast return to health” after seeing a 12th consecutive month of rising used car prices and record online engagement from buyers in March.

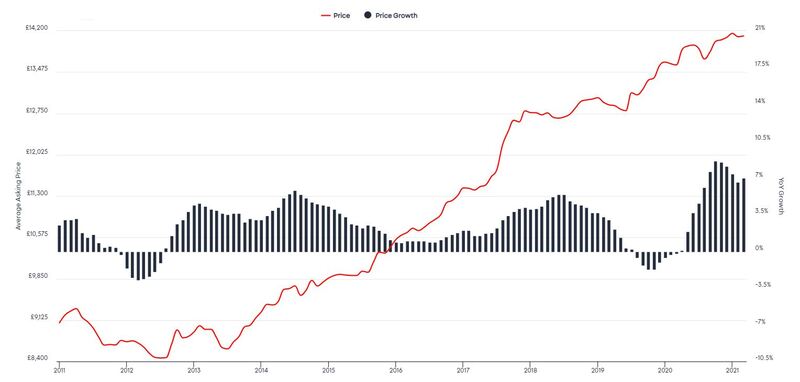

The online marketing platform said that the average value of a used car had risen by 7% year on year and like for like, to £14,110 last month as it recorded a record 69.7 million visits last month.

Auto Trader’s 12th consecutive month of price growth saw an acceleration in values from the 6.6% recorded in February and was the first monthly increase in the rate of growth since October 2020.

March also saw a record amount of time consumers spent on Auto Trader, totalling 10.9 million hours throughout the month – an increase of 22%.

March also saw a record amount of time consumers spent on Auto Trader, totalling 10.9 million hours throughout the month – an increase of 22%.

Auto Trader director of data and insight, Richard Walker, said: “The record demand we’re seeing on our marketplace offers a very positive indication as to what we can expect when in less than a week, retailers across England and Wales will be able to fully reopen their forecourts.

“Coupled with the fact that used car sales are close to what we would typically see in March, and new car performance has been robust despite the current restrictions, we’re confident of a fast return to health.

“And, with such strong demand in the market, we anticipate prices will remain buoyant for some time to come, which will continue to benefit retailers’ profit margins.”

Auto Trader’s positive outlook for used cars comes the day after the Society of Motor Manufacturers and Traders (SMMT) published new car registrations data for March which showed an 11.5% uplift year-on-year to 283,964 units.

The online marketing platform said that its increased online traffic had resulted in 91% growth in leads being sent to retailers last month when compared with March 2019.

Among the data insights gathered, Auto Trader noted that demand for used petrol and diesel jumped from -2.1% YoY and -5.6% in February, to a very robust 35% YoY and 32.9% respectively.

It was the first YoY increase in diesel demand since October 2020, it said.

Levels of supply grew by just 0.4% YoY for petrol and fell 14.2% for diesel, however.

The average price of a used petrol increased 5.8% YoY (£12,705) – flat month-on-month after four months of easing price growth – as average diesel prices increased by 8.9% YoY (£14,708).

Demand for volume electric vehicles (EV) shot up from 18.5% YoY in February, to 131.6% last month, meanwhile, overtaking the strong levels of supply at 117.8%.

This triggered a 9.3% YoY (£19,943) rise in average values.

Auto Trader said that demand for premium EVs had increased from 48.1% YoY in February to 135.9% last month but had failed to match the very strong levels of supply of premium EVs in the market, which increased 278.5% YoY.

As a result, prices fell by 4.2% YoY (£43,313).

On average 2,519 retailers made changes to their vehicles’ pricing on Auto Trader last month – up by just over 1% on March 2019 – with an average daily price reduction of £239 just £64 down YoY.

Login to comment

Comments

No comments have been made yet.