When Snows Motor Group completed a restructure of its leadership team at the turn of the year its new leaders had no idea they would soon be called upon to fast-track a transformation of the business.

Chief executive Stephen Snow had been keen to drive profitability following a three-year period of acquisitions, a string of new site openings and considerablle investment to upgrade its 47 franchised sites to the latest corporate identity standards of its 18 manufacturer partners.

COVID-19 forced a pause in trading, but brought about a rapid ramp-up in new thinking, however.

When Snows Motor Group completed a restructure of its leadership team at the turn of the year its new leaders had no idea they would soon be called upon to fast-track a transformation of the business.

Chief executive Stephen Snow had been keen to drive profitability following a three-year period of acquisitions, a string of new site openings and considerablle investment to upgrade its 47 franchised sites to the latest corporate identity standards of its 18 manufacturer partners.

COVID-19 forced a pause in trading, but brought about a rapid ramp-up in new thinking, however.

Now the group is driving forward with an end-to-end online retail solution and – at the time of AM’s interview – was in the midst of a rationalisation of its workforce which would see it cut 5% of its 900 employees.

“We have looked at every single dealership and the roles which may be deemed ‘a luxury’ and have made redundancies,” said Snow.

“It’s a natural thing to do when there’s a recession. We still don’t know what’s around the corner, what effect Brexit will have on our business. In that situation you need to re-size the business.”

Despite being a period that saw the group relinquish two brands (Citroën and Suzuki) and gain two more (Cupra and London Electric Vehicle Company – LEVC) Snow described 2019 as “a year of consolidation”.

Scrutiny of the business had been intense during the past 18 months, however, with the CEO keen to restructure in a way that prioritised key functions and simplified the leadership structure following more than a decade of consistent growth.

Many of the steps taken both in response to – and to mitigate against – the impact of the pandemic and Brexit have felt like a continuation of the business review that was already under way.

Snow is pleased with the outcome.

“100% we’ve never been leaner, meaner, more efficient or more on top of our game,” he said.

“It’s a pleasure to come into the business and see all our staff maximising every opportunity. We treat every enquiry like gold dust.

“Like any recession, it toughens you up and makes you smarter in everything you do. We’ve realised some of our shortcomings and we’ve been able to make changes and get staff to buy in as they came back to work.”

RESTRUCTURED TEAM

Snow announced he would be heading up a new executive board of directors at the group’s fourth annual conference in January.

While COVID has made the event – the one occasion that all group employees get together each year – an uncertainty for 2021, the business’s structure is now better suited to the challenges ahead, he believes.

Neil McCue and Alex Domone were named as chief operating officers and Shawn Gates as chief financial officer.

In addition to Allen Scott, Snows’ director of marketing, PR and communications, there are also three, newly-appointed directors: Melanie Durrans, human resources; Richard Betts, corporate sales and fleet; and Robert Newbold, finance and insurance including FCA compliance.

Four new general managers: Mark Toms, Mike Maidment, Jon Oakley and Dale Vaughan, were also appointed at the turn of the year, with Rob Newton, Graham Simpson, Michael Ewen and Graham Davis all taking on new franchise aftersales management roles.

Snow said: “The new management structure will mean swift, effective decision-making across the business.

“I’m extremely pleased that many of our homegrown talent have stepped up to take on management responsibilities.”

Snow is a firm believer in the development of the group’s workforce from within and said that managers are empowered to select potential future leaders

and help them progress.

He said the group does not use outside training providers as “the best people to instil the way we want our teams to work are people who have done it themselves”.

While Snow hopes that the current uncertainty of the economic climate and a potential slow-down of its acquisitions will mean that recruitment and training become less of a burden. Staff turnover has been a consistent 20%-to-30% prior to COVID, he said. He is eager to encourage an aspirational workforce.

“We’ve seen some superstars rise in lockdown and we really do like to develop our own talent,” he said.

“What that ensures is that you end up with people that know about the Snows way of doing things and for a family-run group that’s really important. That was a key factor in our leadership restructure.

GROWING PAINS

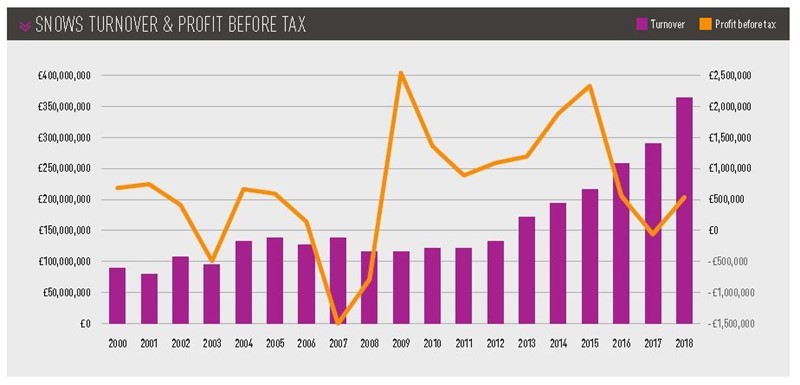

Snows Motor Group’s turnover has been growing since 2009, when the business expanded with the acquisition of Seat franchisee Great Covert plus Toyota & Lexus retailer Ponder. During that period it also founded its Too Good To Auction used car division.

Although the value of sales has grown by almost 286% since then, Snows has delivered varied profitability in its quest for more scale, with a loss before tax in 2017 marking the decade’s low point.

Snow said the group’s 2019 accounts – delayed by the COVID-19 pandemic – would show a turnover up 17.8% at £432 million, alongside a pre-tax profit of £4.3m, resulting in a return-on-sales of 0.53%.

“Not the greatest, but we have been growing the business,” he said.

Snow said the business had suffered “growing pains” but added that 2020’s leadership restructure would go some way to address that.

Snow said the business had suffered “growing pains” but added that 2020’s leadership restructure would go some way to address that.

He said the group’s approach to integrating new businesses had also evolved to prioritise swifter change in recent times. A move from four DMS systems across the group to CDK Drive was another step towards more efficient operating that had proved “an absolute godsend for our financial officer”.

Snow said he had hoped 2020 would be the year the group would be able to deliver improved consistency and a stronger margin.

“We are aiming for 1% return-on-sales as a stepping stone, but, clearly, we’d like to grow that to 1.5%,” he said. “To do that overnight is not realistic. But we do believe that, after the consolidation year in 2019, we were having a strong start to 2020 and were on track to achieve 1%.

Snow was upbeat that the bounce-back out of lockdown would show a return to profitability last month when he analysed the July trading result.

That’s something he couldn’t have foreseen in March and April, he said.

COVID RESPONSE

Snow was quick to highlight the role the Government’s coronavirus job retention scheme (CRJS) had played in his business’s COVID-19 recovery.

Combined with a strong showing in aftersales and resurgent used cars sales since the June 1 reopening of showrooms, the CRJS has made hopes of a swift return to profitability a real possibility.

“With the way we’ve been able to manage our way back into the business using the CRJS, I’d like to think that we’ve maximised that support,” said Snow.

“The other thing has been business rates relief. That has been a real help to us, along with manufacturer support. All the OEMs we represent helped us in terms of cashflow and guaranteed bonuses and all that has helped us minimise losses through the period.”

Snow said the group had also benefitted from the flexibility added to HMRC’s VAT and PAYE time-to-pay payments.

“We did apply for CBILS (the Coronavirus Business Interruption Loan Scheme), but we found it difficult, complex and expensive and, with tight cash control, we decided it was better to keep it there in the background than make full use of it,” he added.

“We’re trying our best to avoid going with CBILS. I don’t know of many dealer groups that have gone with it. The interest rate and term really wasn’t very competitive. If we continue to trade as we are, we’ll be okay.

“Any nervousness we have now is centred on a second lockdown and what that might bring.”

Snow was keen to highlight the positive impact of lockdown.

Admitting that the period had allowed him and the business’s other leaders to “step back and realise our shortcomings”, it brought about the fast-tracking of an end-to-end online retail offering through GForces.

Two of the group’s sales managers were also pulled aside and encouraged to develop a CitNOW ‘best practice’ video training course to help drive the quality of both marketing and digital communication with customers.

Expressing some surprise at the instant take-up of the online offering from customers, Snow said: “We did 18 end-to-end online sales in July and took 200 deposits.

“We’ve only promoted that service online, but, as our employees have come back into the business, they’ve all really bought into it. Rather than getting an enquiry via the website they are now getting an order from the website and the manager will share them around as they see fit.”

“We’ve only promoted that service online, but, as our employees have come back into the business, they’ve all really bought into it. Rather than getting an enquiry via the website they are now getting an order from the website and the manager will share them around as they see fit.”

Snow admitted question marks could hang over the traditional commission model as increasing volumes of orders start to reach the business digitally.

“Commission payments are something we want to review,” he said.

“In Q4, we will probably look at introducing a specialist digital sales team. At the moment, the website provides the deposit and purchase straight into the dealership teams and they will earn commission in the usual way.”

Despite the emergence of online sales, Snow said the group’s customers had yet to embrace home delivery, with few having taken up the offer since it was made available during lockdown.

Instead, customers are increasingly travelling from further afield and are keen to try the car and drive it away there and then.

“What we’re having to do is set up seven-day insurance and point them in the direction of the finance so the car is pretty much sold, pending a test drive,” he

said.

FRANCHISED AND USED

A drive towards increased used car sales has been central to Snows’ strategy in recent years, alongside its aim to continue adding sites with its established

franchisees within its geographic area.

Since 2009, Snows has promoted its used car offering under its Too Good to Auction banner – operating across 10 franchised sites and one solus location – and it managed to deliver a used-to-new ratio up to around two-to-one in 2019.

The group aims to have £21m of used car stock and exercise a 90-day stocking rule, but the challenges of vehicle acquisition this summer saw its inventory shrink to £17m at a time when Snow asserted “we’ve been selling stock faster than we could replace it”.

Last year, the group sold 10,227 used vehicles through its franchised used channels and 2,379 through Too Good To Auction, while retailing 7,751 new vehicles and selling 1,479 to local fleets.

Snow suggested the balance of used-to-new had tipped further this year, with post-lockdown used car sales up 25% year-on-year in June and July.

Aftersales had seen a similar year-on-year increase in revenues.

“We’ve maximised the working days in our aftersales departments, and that includes weekends, to keep up with demand,” said Snow.

“With all the rules that surround PPE (personal protective equipment) and social distancing we wanted to avoid shift work.”

Servicing accounted for £3.5m of Snows’ revenues in 2019, with parts adding a further £4.9m.

Snow is keen to maintain his group’s geographic focus and is happy with the array of franchised partners he now finds himself with following a two in, two out reshuffle last year.

Geely’s LEVC became a Snows franchise in October 2019, but remains a brand with potential as local authorities in Portsmouth and Southampton continue to weigh up the roll-out of ultra-low emissions zones.

“It’s a niche business that’s additional to our value brands,” said Snow.

“The aftersales side is shared with Volvo, but we do have a separate showroom with just two vehicles. It’s a slow burn, but it hasn’t been a huge commitment in terms of investment.”

“The aftersales side is shared with Volvo, but we do have a separate showroom with just two vehicles. It’s a slow burn, but it hasn’t been a huge commitment in terms of investment.”

Mercedes-Benz Vans has proved another challenge for the group after taking on the franchise in Exeter back in 2017.

It was a “cold territory” but Snow said that the prospect of joining the German brand’s franchise had been “too good an opportunity to pass up”.

He said: “We’re making progress every year. It’s been tough. We hoped that in our third year we’d achieve profitability and we had been on course to achieve that prior to COVID.”

With just two showrooms still requiring a CI (corporate identity) upgrade, Snow is hopeful life is about to get a little easier and less expensive from a franchised business point of view.

But, with a new Volvo Car UK showroom in Southampton, one of two pending upgrades, there remained one last sting in the tail.

“There are horrendous costs associated with electric vehicles (EVs) from a retailers’ point of view,” he said.

“We were right in the middle of updating the Volvo dealership when we came to a grinding halt at lockdown. But, just prior to that, we had to put in a substation. That added £110,000 to the cost in order to meet Volvo’s EV standards.

“It’s only because we have come back and June and July have been good months for us that we’ve now got the confidence to get back into that.”

THE SNOWS WORK ETHIC

Snows Group founder Geoff Snow died in hospital, at the age of 85, on August 23, 2017, but son Stephen asserted that his father would have embraced the challenges faced by the car retail sector right now.

Having launched Snows as an office supplies business in Southampton in 1962, he moved into motor retail 40 years ago with a Toyota franchise in the city and retained an active interest in the business

right to the end.

Far from shying away from emissions regulation, Brexit and COVID-19, Stephen believes his father would have enjoyed adapting.

“Geoff would have loved it,” he said. “He would have loved the pace of it all. He loved change and change for the better. My father loved to see his business grow and evolve.

“He was brought up on a farm – his dad was a farm worker – and he went into the Navy as well. He had that work ethic in him and I think that’s what we have instilled. I can’t thank my staff enough for exemplifying that.”

Snow, who took over running the car retail business back in 2007, said that he has no intention of relinquishing the helm any time soon.

While his three daughters have yet to form part of his succession planning, one is already working in the business.

But he said: “I’ve a good few years left in the business yet. The executive directors are younger than me. We have a relatively young team with a lot of experience.”

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.