Growing demand for green cars across Europe has been highlighted in July registrations data that prompted renewed hope for a ‘V-shaped’ COVID-19 recovery in the region.

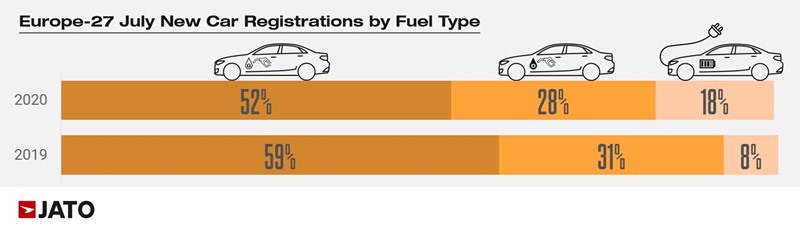

Data published by Jato Dynamics today (August 27) showed that July delivered the highest monthly registrations total since September last year across the 27 analysed markets, with low-emissions electric vehicles (EV) and hybrids accounting for 18% of all new car sales.

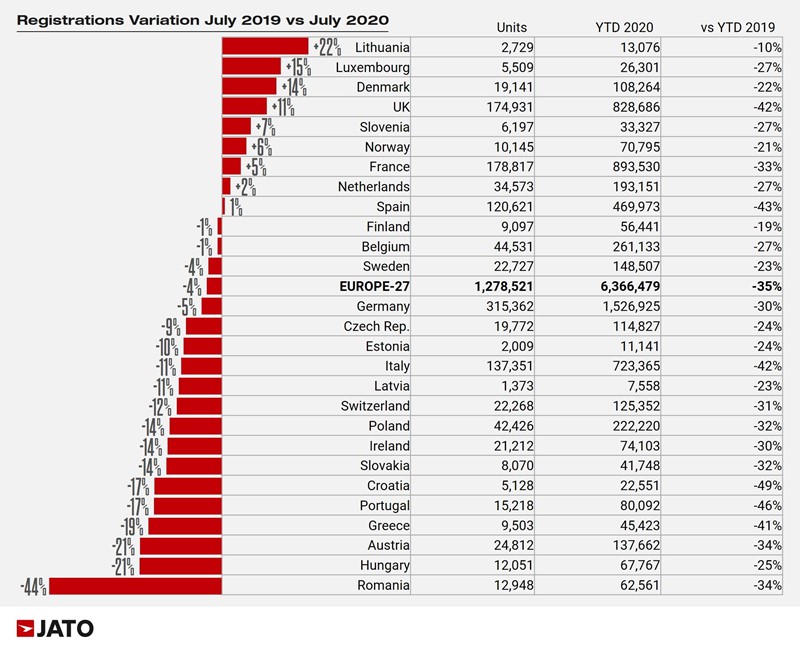

Jato reported that 1,278,521 new cars found new owners across Europe last month, down by only 4% on July 2019, leaving the sector 35% down year-to-date to 6.37 million cars.

The data was published as the Society of Motor Manufacturers and Traders (SMMT) reported that UK car production appeared to have begun a slow recovery, with the volume of vehicles built for export – which accounts for eight-in-10 vehicles produced – down by 16.1% on the same period in 2019.

Reporting on July’s resurgent car sales performance across Europe, Felipe Munoz, global analyst at Jato Dynamics, said: “Both private and business consumers are responding to the better market conditions.

Reporting on July’s resurgent car sales performance across Europe, Felipe Munoz, global analyst at Jato Dynamics, said: “Both private and business consumers are responding to the better market conditions.

“If the current situation continues to improve, we could start to talk about a ‘V’ shaped recovery in the European car industry.

“However, there are still huge uncertainties regarding how and when the pandemic will finally come to an end, therefore caution remains.”

The UK’s 11.3% rise in new car registrations in July, as reported by the SMMT, was highlighted among “healthy figures” achieved across Europe, alongside Denmark (up 14%) and France (up 5%)

In all, eight of the 27 markets analysed delivered a year-on-year increase in new car sales.

In all, eight of the 27 markets analysed delivered a year-on-year increase in new car sales.

AFV sales surge

Jato found that much of the boost in registrations had been accounted for by an increased appetite for green cars, with increased Government incentives and OEM finance offers boosting their sales.

Registrations of alternative fuel vehicles (AFV) rose by 131% year-on-year to 230,700 in July – the first time that these vehicles were bought by more than 200,00 consumers in a single month.

AFVs accounted for 18% of total registrations, far greater than their market share of 7.5% in July 2019, and 5.7% in July 2018.

Munoz said: “The rise in demand for (AFVs) is strongly related to a wider offer that is finally including more affordable choices. The higher competition amongst brands is also pushing down prices.”

Munoz said: “The rise in demand for (AFVs) is strongly related to a wider offer that is finally including more affordable choices. The higher competition amongst brands is also pushing down prices.”

Half of the AFVs registered across Europe during July were powered by a hybrid engine (HEV), with demand soaring by 89%.

Mild hybrid versions of the new Ford Puma and Fiat 500 were among those contributing to the result.

Plug- in hybrids (PHEV) followed with 55,800 units, up by 365% from July 2019, and boosted by new models like the Ford Kuga PHEV – its success was subsequently stalled by battery fire fears – Mercedes A-Class, Volvo XC40 and BMW 3 Series.

Registrations of pure EVs rose from 23,400 units in July 2019 to 53,200 in 2020 as the number of available vehicles rising from 28 to 38, with new models including the Peugeot 208, Mini Electric, MG ZS, Porsche Taycan and Skoda Citigo all new to market.

Jato reported that Tesla had posted a 76% decline to 1,050 units, however, following shipping delays to Europe as a consequence of production challenges in Fremont, California.

Munoz said: “In contrast to the general trend of increasing demand for electric cars, Tesla is losing ground this year in Europe.

“Some of this can be explain by issues relating to the production continuity in California, but also by high competition from brands that play as locals in Europe.”

Other market winners

SUVs accounted for almost 42% of Europe’s total registrations in July (530,800 units), posting the highest monthly volume since July 2019 to become the only segment that delivered growth.

Midsize SUVs were the only segment to record a decrease as they declined 6%, with the small (+9%), compact (+4%) and large/luxury SUVs (+14%) all showing improvements.

In July, 48% of the electrified vehicles registered were SUVs.

Volkswagen’s eighth generation Golf helped this model to regain first place in the rankings, that was previously lost to the Renault Clio in June.

Volkswagen’s eighth generation Golf helped this model to regain first place in the rankings, that was previously lost to the Renault Clio in June.

The Renault Clio recorded another 26% increase, with 89% of that volume attributed to the latest generation.

The Skoda Octavia, Peugeot 208, Renault Captur and Peugeot 2008 also posted double-digit growth thanks to their recently launched new generations.

Other big improvers include the Hyundai Kona (+56%), BMW 3-Series (+59%), Mini Hatch (+26%), Volvo XC40 (+66%), BMW X1 (+49%) and BMW 1-Series (+52%).

The Renault Zoe and Kia Niro increased their registrations by 146% and 111% respectively.

Europe's best selling vehicles during July, 2020:

Login to comment

Comments

No comments have been made yet.